Suggested Reading:

Businesses currently find themselves in unchartered waters as the Covid-19 pandemic situation continues to persist. Even historically profitable businesses are not spared as supply chains globally are disrupted and the future looks bleak. In particular, small and medium enterprises (“SMEs”) have been hit hard. The SBF-Experian SME Index^, which tracks business sentiment specifically for SMEs in Singapore for the next six months, fell from 50.4 in Jan 2020 to 48.3 in April 2020, reaching an all-time low since the establishment of the index in 2009*. To navigate uncertain times, it is crucial for SMEs to review their existing business plans and cash flow forecasts which may be obsolete given the disruption caused by Covid-19.

In our previous Salient Point (Issue 3), we discussed how a company could go about preparing a cash flow forecast. Such a forecast, as mentioned in that article, could be helpful to improve the company’s cash flow visibility under uncertain times. Additionally, cash flow forecast could be used to determine the value of the business using the discounted cash flow (“DCF”) method. Such a valuation could be used for, amongst other things, fund-raising, impairment assessment and/or reporting to stakeholders.

VCC: Transformative Boost to Singapore's Fund Ecosystem

Introduction

The Variable Capital Company (“VCC”) is an alternative form of corporate vehicle that will be available for use as a collective investment scheme (“CIS”), an addition to the existing forms available to use for CIS, being a company under the Companies Act (Cap. 50) (“Companies Act”), a unit trust and a limited partnership. With this new legal framework in place, it is envisaged that investment managers will have greater operational flexibility in the constitution of funds in Singapore, as well as strengthening Singapore's position as a full-service international fund management centre.

Attractive features of the VCC include the ability to redeem shares at the fund’s net asset value (“NAV”) and to pay dividends from capital – unlike a fund constituted as a company. It can also be set-up as an umbrella structure with multiple sub-funds, which can be cost-effective.

Certain tax exemption schemes are extended to VCCs. The Inland Revenue Authority of Singapore treats a VCC as a company and single entity for tax purposes – eliminating the need to file multiple tax returns for sub-funds. Unlike companies, VCCs’ shareholder registers are not required to be made public – thus offering privacy to investors. Singapore fund managers with offshore fund domiciles will now have an option to co-locate fund domiciliation and management activities in Singapore.

Appended below is a summary of the key features and highlights about the VCC:

Key Features

1. The VCC will be regulated by its stand-alone legislation – the Variable Capital Companies Act (“VCC Act”) and the Accounting and Corporate Regulatory Authority (“ACRA”) will administer the VCC Act.

2. The VCC can be used as a CIS vehicle either as a stand-alone entity or as an umbrella entity with multiple sub-funds with segregated assets and liabilities.

3. It is permitted to freely redeem shares and pay dividends using its net assets/capital, thereby providing flexibility in the distribution and return of capital.

4. At least one of the directors must be ordinarily resident in Singapore and also be a director or a qualified representative of VCC’s fund manager. The Directors must also be “fit and proper persons”.

5. The financial statements and register of members are not required to be publicly available.

6. The holding of an Annual General Meeting (“AGM”) can be dispensed with subject to certain safeguards under the VCC Act.

7. A VCC’s assets must be managed by a registered or licensed fund manager in Singapore unless exempted by MAS.

8. Must comply with Anti-Money Laundering/ Countering the Financing of Terrorism (“AML/ CFT”) procedures, which would be supervised by MAS for compliance.

9. An approved custodian must be appointed to supervise custody of the assets of a VCC which is an authorised or restricted CIS.

10. Both open-ended and close-ended funds can adopt the VCC structure and the redemption rights of investors are to be clearly set out in the constitution of the VCC.

11. Foreign corporate entities that are equivalent to a VCC may be re-domiciled as VCCs in Singapore.

Segregation of Assets and Liabilities of Sub-Funds

VCCs will be able to utilise a cellular structure. In this structure, the VCC will be a single legal entity, with its sub-funds operating as separate cells (each without legal personality).

A sub-fund will be constituted by registration with ACRA, which will in turn provide the sub-fund with a unique sub-fund identification number.

To prevent cross-cell contagion, the VCC Act provides for the segregation of assets and liabilities of subfunds, where:

- the assets of a sub-fund cannot be used to discharge the liabilities of or claims against the VCC or any other sub-fund of the VCC; and

- any liability incurred on behalf of or attributable to any sub-fund of a VCC must be discharged solely out of the assets of that sub-fund.

To mitigate against cross-cell contagion, the VCC Act voids any provisions which are inconsistent with the segregation of assets and liabilities of sub-funds and requires the VCC to ensure proper segregation of assets and liabilities of sub-funds. In circumstances where the VCC is dealing with a third party, the VCC has to disclose the cellular structure to the third party.

To protect retail investors, MAS will require that the fund manager of a VCC authorised as a CIS be allowed to invest in assets located in a jurisdiction that does not have a cellular company structure provided if any risk of cross-contagion between the VCC’s sub-funds has been reasonably mitigated.

Share and Share Capital

A VCC will be allowed to freely redeem shares and pay dividends using its capital. This is one of the main advantages of a VCC.

The constitution of a VCC would be deemed to imply the following:

- the value of the paid-up share capital shall be at all times equal to the NAV of the VCC; and

- the shares of the VCC shall be issued, redeemed or repurchased at the price equal to the proportion of the NAV of the VCC represented by each share, subject to adjustments for fees and charges as provided in its constitution.

An exception is available for closed-end funds listed on a securities exchange.

Fund Managers

A VCC must be managed by a fund manager regulated or licensed by the MAS unless exempted under:-

a) the Securities and Futures Act (Cap. 289 (“SFA”);

b) the Banking Act (Cap. 19);

c) the MAS Act (Cap. 186);

d) the Finance Companies Act (Cap. 108);

e) the Insurance Act (Cap. 142).

Meetings, Accounts and Shareholder Register

1. Annual General Meetings

The directors of a VCC may dispense with holding an AGM by giving at least 60 days’ written notice to the shareholders of the VCC. However, shareholder(s) with 10% or more of the total voting rights may require an AGM be held under the VCC Act.

2. Audit and Accounts

VCCs are required to audit their books of accounts which shall be separate for each subfund and they must be prepared in accordance with a single set of accounting standards from the Singapore Accounting Standards Council (“ASC”) or International Financial Reporting Standards (“IFRS”) across all the sub-funds.

Authorised Schemes will need to use the RAP7 accounting standard (currently required for units trusts under the CIS Code). MAS will allow VCCs which do not consist of Authorised Schemes (i.e. VCCs that consist only of Restricted and/or Exempted Schemes, being CIS offered to nonretail investors) the option to prepare their financial statements in US Generally Accepted Accounting Principles ("US GAAP"), in addition to the ASC standard or the IFRS. The financial statements of a VCC are not required to be made available for public inspection.

3. Register of Members

The register of members of a VCC is not required to be open for inspection by the public but must be allowed for inspection by the following persons or upon an order of court:

- the manager of the VCC;

- the custodian of the VCC (being a nonumbrella VCC);

- a public authority (such as the Government, ACRA and the Monetary Authority of Singapore (“MAS”)).

A member is entitled to inspect the register only with respect to information of itself.

Corporate Governance

A VCC must have at least one director who is ordinarily resident in Singapore. At least one director of the VCC must also be a director or qualified representative of the VCC’s fund manager, and its directors will be subject to disqualification and duties broadly similar to those under the Companies Act.

A VCC is required to have its registered office in Singapore and to appoint a Singapore-based company secretary. The naming requirements for a VCC are similar to those under the Companies Act.

Winding Up

The winding up of a VCC is provided for under the VCC Act and it may be wound up (i) voluntarily by its members, or (ii) by a court order provided certain conditions are satisfied. In addition, a sub-fund may be wound up and the shares of the sub-fund redeemed upon its winding up.

There are certain additional grounds for winding up of a VCC. They are as follows:

- the VCC is being used to conduct business outside its permitted use as a vehicle for CIS only;

- the VCC does not have a fund manager duly registered, licensed or exempted by MAS to manage its property for such period as may be prescribed by the regulations under the VCC Act; or

- the VCC breaches its AML/CFT obligations.

Tax

In the 2018 Budget Statement, it had been announced inter alia, that the tax exemption under sections 13R and 13X of the Income Tax Act will be extended to VCCs; the 10% concessionary tax rate under the Financial Sector Incentive–Fund Management scheme will be extended to approved fund managers managing incentivised VCCs; and the existing GST remission for funds will be extended to incentivised VCCs.

Beyond these, the tax treatment for VCCs will also have to take into account the unique characteristics of this new structure.

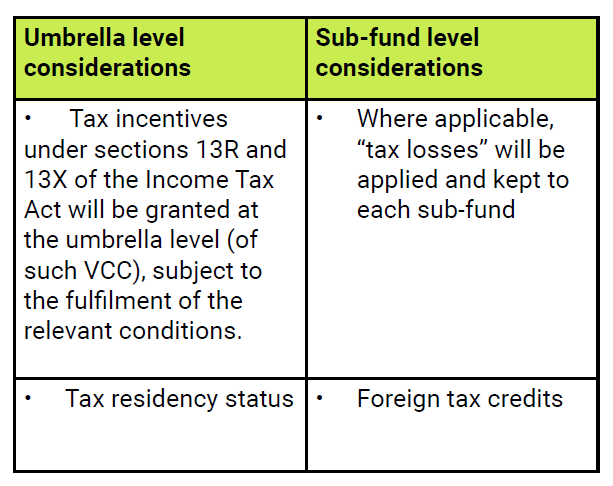

For example, while a VCC will be treated as a company and a single entity for corporate income tax purposes, in the context of umbrella VCC (with sub-funds), there are certain aspects that need to be considered at the umbrella level (while others are addressed at the subfund level).

These include the following (non-exhaustive) aspects:

The requirement to address certain tax aspects specifically at the sub-fund level, also extends to GST and stamp duty assessments, and should be carefully considered.

Further, while some tax schemes (e.g. certain special deductions, group relief etc) will not be available to VCCs, notably the relatively new tax framework for re-domiciliation of companies into Singapore will (with necessary modifications) be extended to the re-domiciliation of VCCs.

Overall, the tax considerations for a VCC structure can be multi-faceted and should be examined early in the planning process.

The announcement on 15 January 2020 on the formal launch of the VCC framework reflects the start of a promising new era. Coupled with the recently-announced Budget 2020 measures proposing for the Section 13H tax incentive (referable to venture capital funds) to include VCCs as well, the future ahead continues to look promising for this segment from a tax standpoint.

Download The Salient Point - VCC: Transformative Boost to Singapore's Fund Ecosystem

>> Back to The Salient Point>> Main Page

DISCLAIMER: All opinions, conclusions, or recommendations in this article are reasonably held by Baker Tilly at the time of compilation but are subject to change without notice to you. Whilst every effort has been made to ensure the accuracy of the contents in this article, the information in this article is not designed to address any particular circumstance, individual or entity. Users should not act upon it without seeking professional advice relevant to the particular situation. We will not accept liability for any loss or damage suffered by any person directly or indirectly through reliance upon the information contained in this article.