For improved accountability, the Code of Governance for Charities and Institutions of a Public Character (IPC) aims to set out principles and best practices in governance and transparency of charities in Singapore. Charities and IPCs should apply the refined Code for financial year commencing from 1 January 2018.

Charities that hold their funds in investments rather than fixed deposits would likely be affected by the changes in the accounting standards; with FRS 109 Financial Instruments having replaced FRS 39 Financial Instruments: Recognition and Measurement from 1 January 2018.

New Financial Instruments standard – Impact on Charities

By: Susan Foong, Partner & Practice Leader, Assurance (FCA (Singapore), FCCA)

Charities that hold their funds in investments rather than fixed deposits would likely be affected by the changes in the accounting standards; with FRS 109 Financial Instruments having replaced FRS 39 Financial Instruments: Recognition and Measurement from 1 January 2018.

FRS 109 Financial Instruments is effective for all entities adopting Singapore Financial Reporting standards as their accounting framework. Banks and financial institutions are most affected by the new standard but corporates and non-financial entities are also impacted.

There is potential impact on charities that place their funds in investments following the adoption of FRS 109. This means that there will be assessments and decisions to be made upon transition to the new standard. In this article, we look at the potential impact of FRS 109 on charities that invest their funds in bonds.

Classification of bonds under FRS 109

FRS 109 brings changes to three major areas: the impact of the business model on accounting and classification of financial assets, the new expected credit loss model for impairment and the easing of hedge accounting rules.

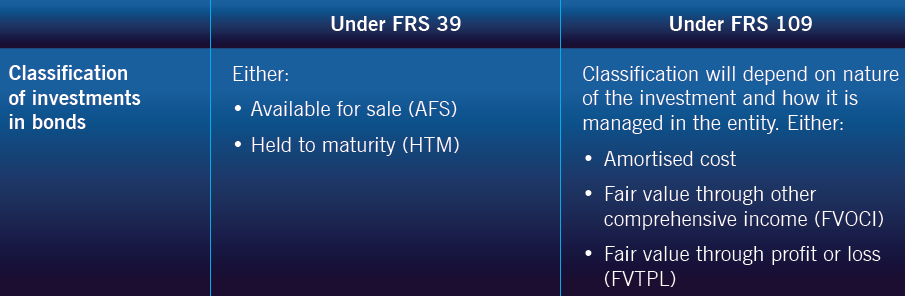

While the classification of financial liabilities will not normally change, the classification of financial assets will depend on their nature and how they are managed in the entity. Under FRS 39, many charities may have categorised their investments in bonds currently as “available for sale” financial assets (AFS) or “held to maturity” (HTM). What was categorised as AFS under FRS 39 is now termed as “fair value through other comprehensive income (FVOCI) in FRS 109. HTM classification has also been merged with “loans and receivables” into a single category of “amortised cost” financial assets in FRS 109.

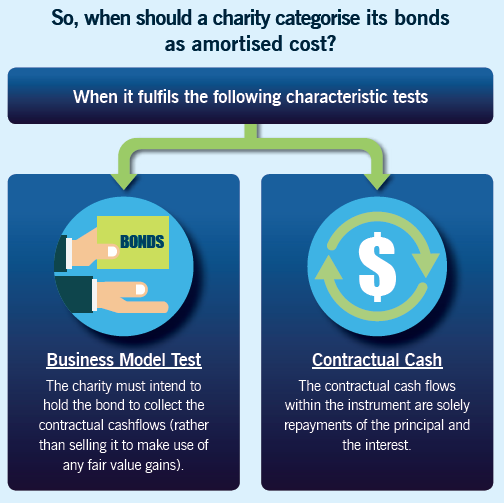

With the adoption of FRS 109, a charity should categorise its investment in bonds either at amortised cost, FVOCI or FVTPL. For charities that have been classifying their bonds as HTM under FRS 39, there are no major accounting differences between the amortised cost category in FRS 109 as compared to classifying and measuring the bonds as HTM under FRS 39.

If the charity cannot satisfy the tests for amortised cost, the bonds are to be categorised as FVOCI. Of course, this is subject to the bonds fulfilling the requirements of the FVOCI characteristic tests. For categorisation as FVOCI, there is an important requirement in addition to meeting the contractual cash flow characteristics test (where the contractual cash flows of the bond should be solely repayments of principal and interest).

The bonds should be held under a business model where they are managed to achieve a particular objective; collecting contractual cash flows as well as the sale of the bond. The charity could decide to sell the bond in order to meet its cash flow needs or when there is a gain in the market value.

Bonds classified as FVOCI are carried at fair values at the balance sheet date and changes in fair value are taken to other comprehensive income (OCI) in reserve/fund account. Upon derecognition, the cumulative fair value change recognised in OCI is recycled to profit or loss.

For charities that hold bonds for trading – or if they manage the bonds with the main objective of realising cash flows through the sale of the bonds – FRS 109 requires these bonds to be measured at fair value through profit or loss (FVTPL). Bonds categorised as FVTPL are measured at their fair values with fair value gains or losses taken to profit or loss.

As FRS 109 is already effective, charities should start looking at their investments in bonds now and review the categorisation and measurement of its investments with the adoption of FRS 109. For charities with financial year end of 31 December, FRS 109 would need to be adopted in their 31 December 2018 financial statements.

For more information on FRS 109, please contact Baker Tilly TFW professionals at +65 6336 2828

Get in touch with the author(s):

Susan Foong

Partner & Practice Leader

Assurance![]() | Email

| Email

>> Back to The Salient Point>> Main Page

DISCLAIMER: All opinions, conclusions, or recommendations in this article are reasonably held by Baker Tilly at the time of compilation but are subject to change without notice to you. Whilst every effort has been made to ensure the accuracy of the contents in this article, the information in this article is not designed to address any particular circumstance, individual or entity. Users should not act upon it without seeking professional advice relevant to the particular situation. We will not accept liability for any loss or damage suffered by any person directly or indirectly through reliance upon the information contained in this article.