The pandemic has shone the spotlight firmly on the need for businesses to embrace change, to react quickly based on high quality information. While technology increasingly takes a front seat in driving the activities of many businesses, the human touch should not be underestimated...

Effective 1 July 2021, businesses which focus on e-commerce supplies of goods within the EU will be subject to new VAT rules. The current distance selling scheme will alter. Currently, a business that supplies goods to final consumers in other EU Member States is often required to charge and pay VAT...

Riding on the momentum to move backwards

By: Loh Eng Kiat, Tax Practice Leader at Baker Tilly Singapore ![]()

(First published on The Business Times, October 28, 2020)

In confirming recently that UK Chancellor Rishi Sunak's Autumn Budget had been cancelled, his office issued a statement saying: "…now is not the right time to outline long-term plans - people want to see us focused on the here and now".

Locally, Deputy Prime Minister Heng Swee Keat similarly sent a clear signal to anyone who might still be harbouring misguided hopes of expansive fiscal measures, by emphasising in his Facebook post on Oct 3, 2020 that "…there will not be a new round of support measures".

Aligning with the theme of being targeted and offering an immediate suggestion, I detail below my sole Budget wish of a trending tax reform measure, centring on the business case for liberalising Singapore's Loss Carry-Back Relief (LCBR) system.

A historical overview of LCBR

Although income tax was introduced in Singapore in 1947, it is my belief that a LCBR system was seriously discussed at the policy level only from the year 2002, by way of it being put forward as one of the tax recommendations of the Economic Review Committee (ERC).

Before LCBR, carry-forward relief was, for many years, the only relief available for losses that cannot be completely used due to insufficiency of taxable income. As a tax recommendation of the ERC back then, it is fair to posit that the introduction of a LCBR system was regarded as a move which would not lead to significant losses in government revenue. Indeed, the ERC recognised that while a LCBR system may lead to greater uncertainty in government revenue, there ought to be no long-term impact on government revenue as the system already allows losses to be carried forward.

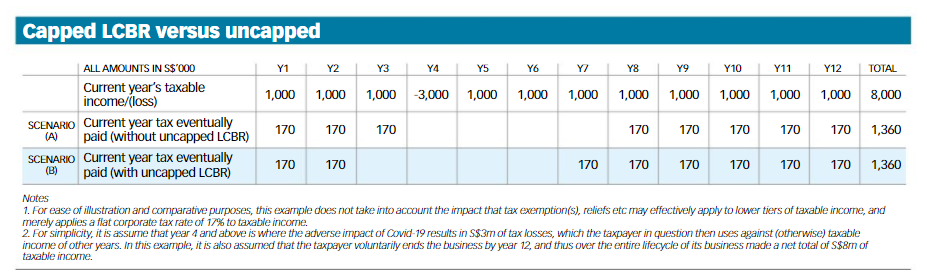

For ease of illustration, one may refer to the accompanying Table 1 which compares the total tax collected over the lifecycle of a hypothetical corporate taxpayer under (a) scenario where LCBR system is not used; and (b) scenario where LCBR is used to allow losses to be carried back for one year. As Table 1 illustrates, the total tax collected over the lifecycle under both scenarios would be the same (S$1.36 million in this example). This reinforces the point that a LCBR system only results in timing differences for tax collection, and importantly, does not result in loss of revenue to the government.

Be that as it may, although the LCBR recommendation was known to have been put up for consideration in time for Budget 2002, it was not until Budget 2005 that a LCBR was introduced. When it was launched, LCBR was subject to a cap of S$100,000 in losses. The cap clearly signified that the LCBR scheme introduced in that Budget some 15 years ago was originally aimed at relieving small businesses to help them cope with cash-flow problems.

Today, the S$100,000 cap still exists, although a temporary increase to the cap did occur before, notably around the time of the Global Financial Crisis where a S$200,000 cap applied for some years. However, the prevailing atmosphere where many larger businesses similarly require significant cash-flow support, arguably presents strong imperatives to reconsider the continued necessity for a capped LCBR approach.

From a cashflow benefit perspective, with Singapore's prevailing corporate tax rate of 17 per cent and a maximum amount of S$100,000 allowed for LCBR, the current system can at best provide a single company (no matter how big) with income tax refund of S$17,000 in a relevant year. This hardly seems like a quantum of life-saving proportions for many businesses facing business restrictions while concurrently sustaining livelihoods of their employees, with the unfortunate example of local SME Teo Heng KTV reportedly sustaining about S$500,000 losses per month since March 2020 springing to mind.

The imperative for liberalising LCBR

The case of an exceptionally large corporate can showcase the full benefits of an uncapped LCBR regime. In a contemporaneous setting, the fiscal history of an organisation like Singapore Airlines (which reportedly recently recorded a first annual net loss in its 48-year history) could demonstrate this distinctly.

Simply put, an uncapped LCBR regime has the potential of allowing Singapore Airlines to obtain income tax refund of around S$36.04 million (assuming the following: their reported full-year net loss of S$212 million is only referable to one main legal entity and approximates current-year unutilised trade losses to be effected at 17 per cent for Singapore tax purposes; their reported earnings of S$683 million in the previous year were similarly only referable to that same main legal entity and were largely taxable at 17 per cent in Singapore).

The said potential refund of S$36.04 million is simply calculated by multiplying S$212 million by the 17 per cent tax rate, but the point is that if the scope of the current LCBR regime with a S$100,000 cap was to operate, ceteris paribus the income tax refund could have been only S$17,000. Anecdotally, if one were to infer from recent press reports disclosing the plight and pay packages of affected aircrew, it may be that such a S$17,000 refund from the current LCBR regime is not quite sufficient to fund a month's salary for an experienced pilot.

A few further points ought to be reiterated within the context of this example pertaining to Singapore Airlines:

- Unless the national carrier does not recover, subsequently fails and never pays income taxes in Singapore again, the said S$36.04 million does not represent a permanent loss of government revenue even if it amounts to a short-term cash-flow impact. Relating this to the illustration in Table 1, the uncapped LCBR allows a full corporate income tax refund for the immediate year before the crisis, thus providing an additional form of cash-flow relief in today's trying times. It also means that when its business recovers in due course, Singapore Airlines should correspondingly resume paying corporate income taxes quicker since some losses have been used up earlier due to LCBR.

- While the quantums involved under an uncapped LCBR are much more meaningful, these may not necessarily represent any real drain on government spending and reserves. This can be contrasted against other fiscal measures like the Jobs Support Scheme (JSS), where to date more than S$21.5 billion in JSS support have already been disbursed.

- By continuing to impose a limit on the number of years of assessment (currently three as announced in the 2020 Budget Statement) to which LCBR can apply, the worst-case scenario from a loss of government revenue perspective can never extend to the income taxes previously paid and referable to the first 45 years' history of Singapore Airlines. In the above numerical example, the first 47 years of income taxes previously paid will remain intact.

International tax attitude

It would be remiss not to make some specific references to loss carry-back measures internationally as well as related reform in vogue during such trying times for several countries. The Australian government announced on Oct 6, 2020 that it will introduce a temporary loss carry-back measure to support certain businesses, and where conditions are met the offset is to be uncapped. According to a recent report by the Sydney Morning Herald, "…A string of rich nations have introduced or expanded their loss carry-back provisions this year because of the losses inflicted on usually profitable companies by the pandemic. They include the United States, Britain, Germany, Austria, Japan and New Zealand…"

In relation to an uncapped carry-back approach, it is noted that at least two OECD member countries (Canada and Ireland) do not impose a numerical limit on the losses, even if they do regulate the number of years the relevant losses may be carried back. It is my understanding that such an approach pre-dates the current pandemic.

Closer to home, in August 2020 the Hong Kong Financial Services Development Council (via FSDC Paper No 46 titled "Hong Kong Catching Up - Modernising Hong Kong's Tax Loss Relief") issued recommendations including their view of the importance that can be played by the territory launching a loss carry-back option in ensuring Hong Kong can stay competitive in the global market. This specific view of the Council is not necessarily new and had also been presented before in recent but "normal" times, such as in 2017.

Backwards as the way forward

To conclude, it is my view that Budget 2021 represents a significant opportunity for the government to take a decisive move in removing the cap associated with the LCBR system. Such a move should, in the long term, be revenue-neutral for the government, unless pervasive business failures become rife. As of now, I remain optimistic for Team Singapore. In concluding remarks in his recent ministerial statement in Parliament, Mr Heng indicated his confidence that the country will continue thriving as an exciting and vibrant global city and "…emerge stronger as a cohesive and resilient nation".

The government recently expressed its intention to pivot from broadbased relief like the JSS, to more targeted support, including help for firms in sectors that are suffering a temporary drop in demand now (but which will eventually recover). A liberalised LCBR system as part of Budget 2021 will be an excellent (and yet remarkably risk-free) way for the finance ministry to "put one's money where one's mouth is".

Illustration source: The Business Times

>> Back to Baker Tilly Singapore Coronavirus Resource Hub>> Main Page

DISCLAIMER: All opinions, conclusions, or recommendations in this article are reasonably held by Baker Tilly at the time of compilation but are subject to change without notice to you. Whilst every effort has been made to ensure the accuracy of the contents in this article, the information in this article is not designed to address any particular circumstance, individual or entity. Users should not act upon it without seeking professional advice relevant to the particular situation. We will not accept liability for any loss or damage suffered by any person directly or indirectly through reliance upon the information contained in this article.