Climate change has become an undeniable and immediate challenge for us as the effects are widespread, intensifying and more actions need to be taken now. In light of this urgency, I resonate with the Sustainability Reporting Advisory Committee’s (“SRAC”) move to “Turn Climate Ambition into Action in Singapore” and the recently mandated climate-related disclosures ("CRD") in a phased approach.

Singapore will be implementing a roadmap, based on SRAC’s recommendations, which involves mandatory climate reporting using a phased and tiered implementation timeline.

An important area to note is the baseline requirement to apply the International Sustainability Standards Board (ISSB) Standards for mandatory climate reporting disclosures.

Have you uncovered the requirements of the ISSB Standards?

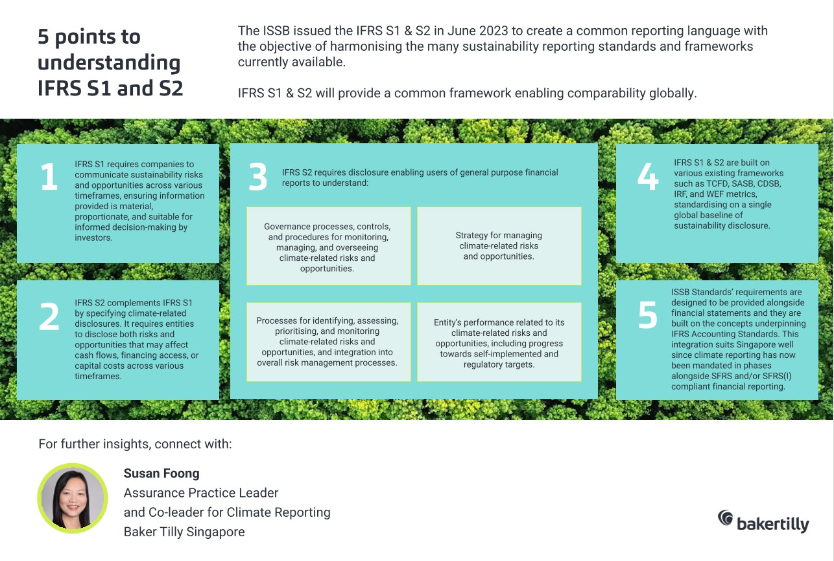

Five points to understanding IFRS S1 & S2

- IFRS S1 requires companies to communicate sustainability risks and opportunities across various timeframes, ensuring information provided is material, proportionate, and suitable for informed decision-making by investors.

- IFRS S2 complements IFRS S1 by specifying climate-related disclosures. It requires entitiesto disclose both risks and opportunities that may affect cash flows, financing access, or capital costs across various timeframes.

- IFRS S2 requires disclosure enabling users of general purpose financial reports to understand:

- Governance processes, controls, and procedures for monitoring, managing, and overseeing climate-related risks and opportunities.

- Strategy for managing climate-related risks and opportunities.

- Processes for identifying, assessing, prioritising, and monitoring climate-related risks and opportunities, and integration into overall risk management processes.

- Entity’s performance related to its climate-related risks and opportunities, including progress towards self-implemented and regulatory targets.

4. IFRS S1 & S2 are built on various existing frameworks such as TCFD, SASB, CDSB, IRF, and WEF metrics, standardising on a single global baseline of sustainability disclosure.

5. ISSB Standards’ requirements are designed to be provided alongside financial statements and they are built on the concepts underpinning IFRS Accounting Standards. This integration suits Singapore well since climate reporting has now been mandated in phases alongside SFRS and/or SFRS(I) compliant financial reporting.

If you would like to discuss any of the points in this article, please speak to us at Baker Tilly Singapore.