Navigating Impairment Testing Challenges (Part 2 of 2)

From Valuer’s Perspective: Understanding International Financial Reporting Standards 16 (Leases) (“IFRS 16”) and How It Affects Impairment Testing

The Misalignment:

Pre- and Post-IFRS 16 Discount Rate to Cashflow Forecast

- In our earlier post in Part 1, we discussed the difference between Pre- and Post-IFRS 16 discount rate.

- In Part 2, we explain how IFRS 16 impacts the cash flow forecast and therefore matching the right discount rate to the cashflow forecast is important.

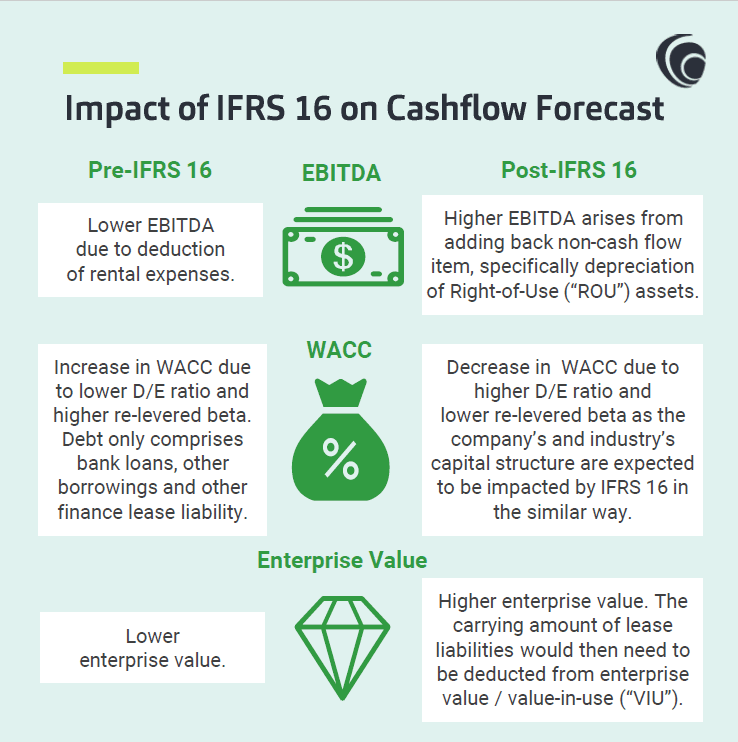

Impact of IFRS 16 on Cashflow Forecast

The Inconsistent Comparison:

Value-in-Use vs Carrying Value

- Inconsistency arises when the cashflow forecast are assessed on pre-IFRS 16 basis, and the VIU is then compared against post-IFRS 16 carrying amount as extracted from the statement of financial position.

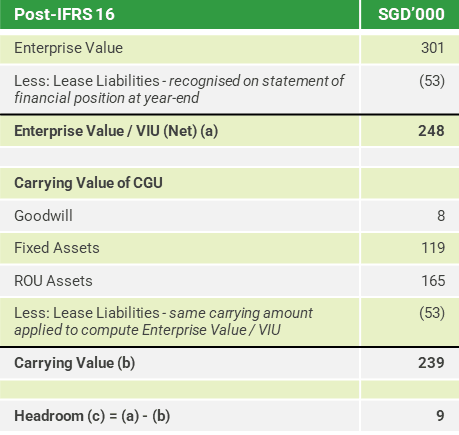

- It is also important to note that the same carrying amount of lease liabilities would need to be deducted when determining carrying value of CGU and its VIU.

“Consistency is a Key Practice in Impairment Testing”

Impairment Testing: Post-IFRS 16

It is crucial to hire a professional valuer to properly assess the impairment testing of the cash-generating unit.

Otherwise, incorrect assessment may cause the financial performance of your company to take a hit on the financial year, which is a problem if your company is publicly listed.

Contact us to have a discussion and let us be your adviser to resolve your valuation-related issues today!

Get in touch