Liquidation = Failure

Reality: Liquidation isn’t always about financial distress—it can also be a strategic decision.

Liquidation can be for strategic reasons, such as completing their original objectives, facilitating shareholder decisions, or closing entities to reduce ongoing costs. It can be a proactive way to close a chapter smoothly, efficiently, and on your terms.

Liquidation = Director's Bankruptcy

Reality: Many directors fear that liquidating a company will damage their personal financial standing—but that’s not always true.

In most cases, the process of liquidating an insolvent company does not automatically make the director personally insolvent.

During a liquidation, creditors are unable to pursue directors’ personal assets—unless there are personal guarantees or proven misconduct.

Liquidation = Disqualification

Reality: Being a director of a company that is placed in liquidation does not mean the director(s) are banned from future directorships.

In Singapore, liquidation alone does not lead to disqualification. Disqualification may only arise if the liquidation was due to insolvency and the director’s conduct was found to be unfit for company management.

Thus, it does not prevent one from pursuing directorships in other companies.

In fact, many directors continue to manage other local and foreign companies even after one of their companies has been liquidated.

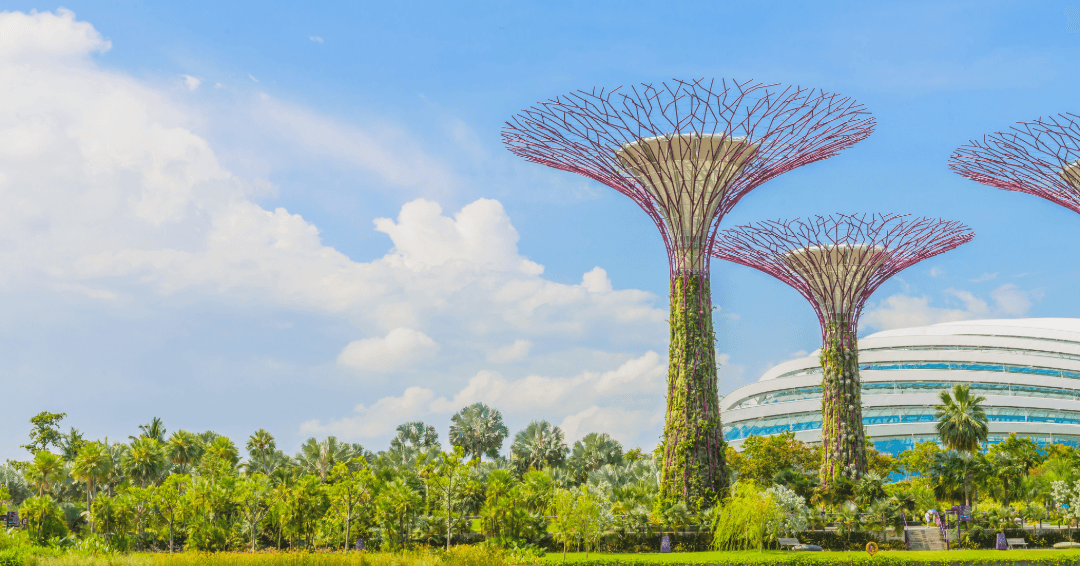

Liquidation Reframed: Beyond the Stigma

Although liquidation is often stigmatised due to misconceptions about reputational harm, we view it differently.

Liquidation should be recognised as a proactive, responsible, and strategic measure that enables the orderly closure of a business.